- Personal Finance Class

- Personal Finance Class

- Personal Finance Company Pay Online

- Personal Finance Form

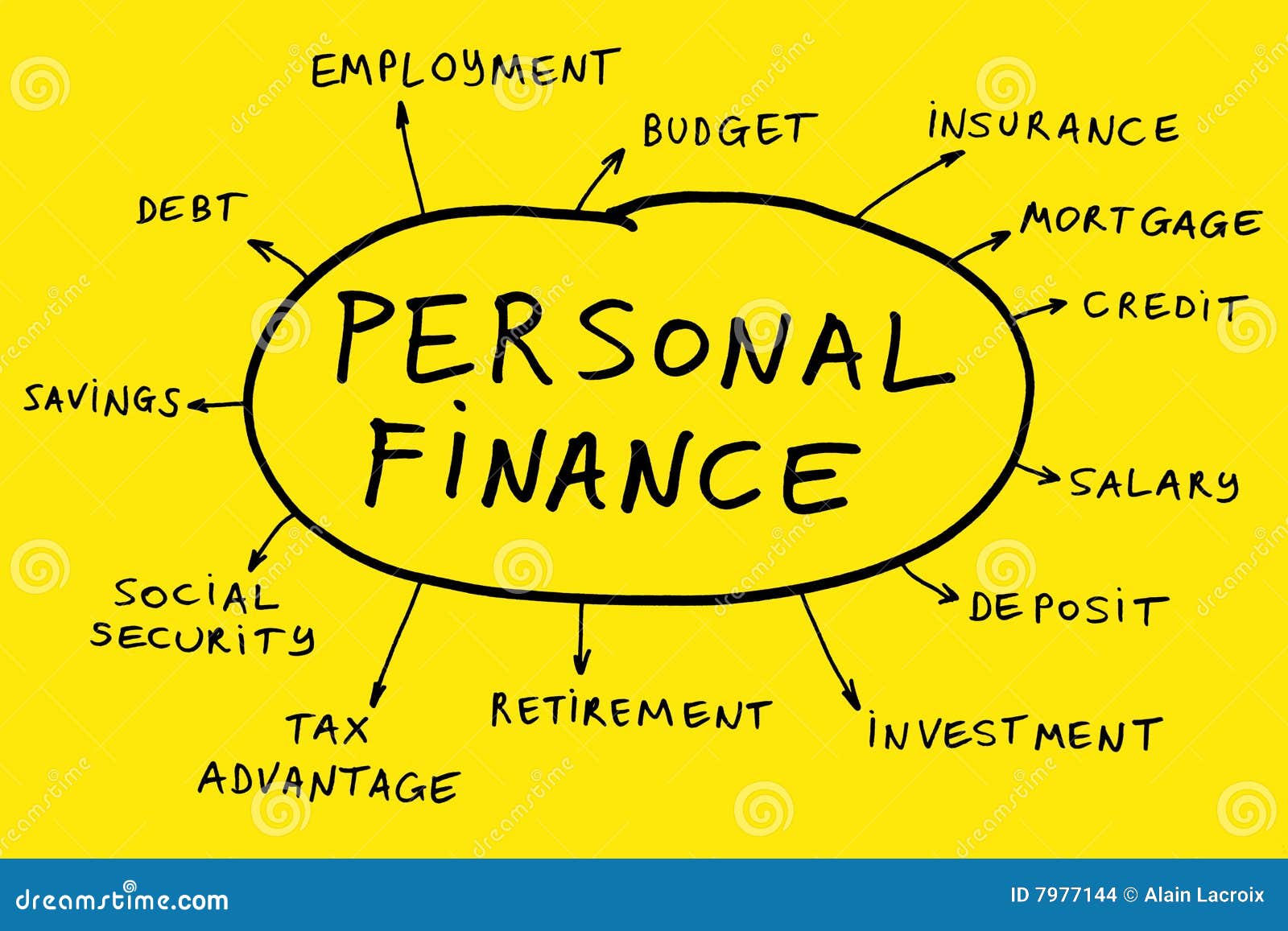

Some personal finance software can help you master budgeting and expense tracking, while others can help with investment portfolio management. Of course, your budget for personal finance software matters, too. Our list of the best personal finance software includes free and paid options to suit a variety of financial goals.

One of the few schools in the nation to offer a BS degree in personal finance, UW–Madison is named a top 35 great college for this program in Financial Planning magazine. A unique hybrid of financial planning and consumer finance, this degree is interdisciplinary, practical, and hands-on. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express.

Bachelor of Science in Personal Finance: Personal Finance

The online BS in Personal Finance is a flexible option that prepares you for a variety of careers in a growing industry.

Is this program right for you?

Do you have a knack for numbers and a desire to help others while working in a promising career field? If so, the UW–Madison Online BS in Personal Finance is the right program for you.

UW–Madison has offered education in family and individual financial health since 1903. With a strong history, this program combines an emphasis on financial management with the economic well-being of individuals and families. You will learn analytical and problem solving skills, communication and listening, and empathy, as well as financial industry skills.

Students will learn key concepts in the curriculum, including principles of financial planning and development, risk and insurance, taxation, investment planning, retirement and savings, and estate planning. All graduates who complete the Certified Financial Planner (CFP) required courses leave fully prepared to sit for the CFP exam.

By combining finance and problem-solving with helping people, the BS in Personal Finance prepares you for a rewarding career in a rapidly growing field. Students will graduate equipped to serve the needs of a variety of clients and work in a broad range of finance jobs, such as financial analyst, risk management specialist, community educator, investment associate, product manager, or business development consultant.

See an infographic that illustrates the benefits of a personal finance degree from UW–Madison Online.

At-a-glance

Format

Program type

Tuition

Resident & nonresident:

$575 per credit

No segregated fees, but other fees may apply.

International eligible

Yes

Classification of Instructional Programs (CIP):

52.0804

Get information on international admissions and visas.

Offered by

Degree conferred

Bachelor of Science in Personal Finance: Personal Finance

Is this program right for you?

Do you have a knack for numbers and a desire to help others while working in a promising career field? If so, the UW–Madison Online BS in Personal Finance is the right program for you.

UW–Madison has offered education in family and individual financial health since 1903. With a strong history, this program combines an emphasis on financial management with the economic well-being of individuals and families. You will learn analytical and problem solving skills, communication and listening, and empathy, as well as financial industry skills.

Students will learn key concepts in the curriculum, including principles of financial planning and development, risk and insurance, taxation, investment planning, retirement and savings, and estate planning. All graduates who complete the Certified Financial Planner (CFP) required courses leave fully prepared to sit for the CFP exam.

By combining finance and problem-solving with helping people, the BS in Personal Finance prepares you for a rewarding career in a rapidly growing field. Students will graduate equipped to serve the needs of a variety of clients and work in a broad range of finance jobs, such as financial analyst, risk management specialist, community educator, investment associate, product manager, or business development consultant.

See an infographic that illustrates the benefits of a personal finance degree from UW–Madison Online.

To be considered for UW–Madison Online you must be a transfer student. A transfer student is anyone who has attended another college or university after graduating from high school and wishes to enroll in an undergraduate degree program at UW–Madison.

Personal Finance Class

In order to be eligible for transfer admission for UW–Madison Online, you must have completed at least 12 transferable semester hours of college-level work. AP, A-Level, IB, and CLEP cannot be used toward the 12 transferable credit requirement. Freshman applicants are not eligible for admission to UW–Madison Online. A freshman includes anyone who is currently a student in high school or who has not taken college coursework since graduating from high school.

Connect with us

Program Overview: Personal Finance BS

February 03

7-7:30 p.m.

Join our enrollment coach to get more information about the BS in Personal Finance including the application requirements and process.

Register for Personal Finance Webinar

Application Assistance: Personal Finance BS

March 02

noon-12:30 p.m.

Join our enrollment coach to learn more about the BS in Personal Finance application process and strategies to make your application stand out.

Register for Personal Finance Webinar

- One of the few schools in the nation to offer a BS degree in personal finance, UW–Madison is named a top 35 great college for this program in Financial Planning magazine.

- A unique hybrid of financial planning and consumer finance, this degree is interdisciplinary, practical, and hands-on. Faculty engage with the UW–Madison Center for Financial Security, nationally recognized for its focus on vulnerable populations. The program provides the perfect place for students interested in numbers as well as impacting a greater good.

- All graduates who complete certain courses leave fully prepared to sit for the Certified Financial Planner (CFP) exam, which our students pass at a rate well above the national average. And students will be entering a growing field: The Bureau of Labor Statistics projects 15 percent growth in personal finance careers from 2016 to 2026.

The personal finance degree at UW–Madison is ranked #2 in top colleges for financial planning by WealthManagement.com.

All courses are online so you can learn from anywhere in the world. The program is designed for part-time students so you can keep career and family commitments.

Personal finance core

- Consumer Research & Analysis

- Consumer Finance

- Accounting Principles

- The Consumer and the Market

- Consumer Behavior

Financial planning courses

- Advanced Consumer Finance

- Estate Planning for Financial Planners

- Family Financial Counseling

- Household Risk Management

Professional development

- Financial Leadership Symposium

- Career & Leadership Development

The courses above are required for BS in Personal Finance online majors. In addition to required courses for the BS in Personal Finance online major, all students are required to fulfill a minimum set of general education requirements and a minimum of 120 total credits to ensure that every graduate acquires the essential core of an undergraduate education.

Connect with our enrollment coaches

Our friendly, knowledgeable enrollment coaches are here to answer your questions. Contact an enrollment coach to:

- Learn how this program can fit into your life

- Learn more about credit transfers

- Get help with your application

- Discuss financial aid options

We’re here for you.

Personal Finance Class

My goal is to become a partner (in my financial firm) one day. UW–Madison is helping me get there.

Sara Strohmaier, Personal Finance graduateInfographic shows benefits of a personal finance degree

Q&A with a UW–Madison personal finance professor

Personal Finance Company Pay Online